THIS ISSUE: 03 Feb - 09 Feb

Tough times – for retailers in the UK, for some of our great businesses whose bottom lines are impacted by economic forces beyond their control, and especially for the people of South Africa, reeling from last week’s fuel price increase and anxiously awaiting Eskom’s rate hike in April. And on a lesser scale, tough times also for lovers of Hellmann’s. Enjoy (if you still can) the read.

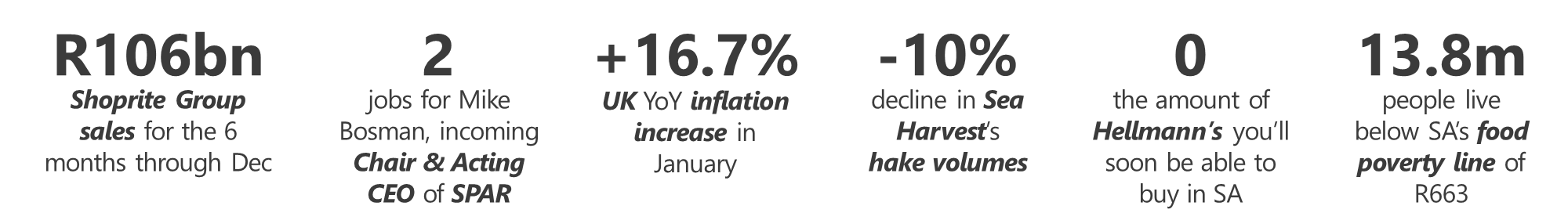

YOUR NUMBERS THIS WEEK

RETAILERS AND WHOLESALERS

-

Shoprite Diesel the days of our lives

A Shoprite trading update, which sort of snuck up on us while we were reading our Aussie newspaper ads. Sales were up +16.8% across the Group to north of 106 billions of ront, with SA supermarkets, contributing around 80% of that, up an even-more-impressive +17.5%, or +11% on a like-store basis. How did The Big Red One manage this? By absolutely shooting the lights out, if you’ll pardon the expression, on Black Friday and over the festive season. Breaking it down further, Checkers and Checkers Hyper recorded sales growth of +16.9%, with Shoprite and Usave coming in at +15.1%. Sales in the rest of Africa, which makes up 9.4% of the total business, rose +17.5% for the period. And will Sir be having any downsides with that? Sadly yes: the business has forked out over R560m on diesel so far this FY and looks good to break a billion by the end of it. And a +56% increase in fuel prices in the supply chain was also difficult to swallow. While selling inflation roared through at +9.4%, Shoprite reckons savvy punters made a lot of that back if they joined the Xtra Savings programme.

Comment: A giant of retail, trading effectively in difficult times for businesses and shoppers alike.

-

-

Pick n Pay A little Bit goes a long way

Congrats, we suppose, to Pick n Pay, which now allows punters to pay for their groceries using Bitcoin at 1,500 stores around South Africa, using the Lightning network. We don’t pretend to fully understand how these things work, but it seems to be a partnership of some sort with CryptoConvert, whose CryptoQR platform will enable the transactions. Regular transactions on the Bitcoin blockchain can take between 30 minutes and an hour to settle, depending on how sure the receiver wants to be that it is legitimate; the Lightning Network is something known as a scaling layer for Bitcoin that offers near-instant transactions and lower network fees. Shoppers will also be able to buy airtime, electricity, flight and bus tickets, and pay municipal bills with Bitcoin. And the point of it all? “Increasingly, cryptocurrency is being used by those under-served by traditional banking systems, or by those wanting to pay and exchange money in a cheaper and really convenient way,” says Pick n Pay, who also points out that Bitcoin transactions are cheaper than using a credit card, and cheaper for the business than handling cash.

Comment: Bitcoin has captured the imagination of South African punters in a way that it hasn’t in many other countries. Nice one PnP for the first-mover advantage.

-

-

In Brief He leaps tall buildings in a single bound!

An update from SPAR, whose woes have been well-documented in these pages and elsewhere. Incoming (and indeed swashbuckling) Board Chair Mike Bosman – ex of FCB North America, Spur, Investec, MTN, AVI and just about anywhere else you care to mention – will also be taking up the reins as interim CEO while a replacement for Brett Botten is sought. Another appointment of some significance this week is that of Karen Ferrini, at Massmart, as vice president of home improvement, DIY and building materials retailer Builders and member of the Massmart executive committee. She comes to the position from Procter & Gamble, where over 11 years she held positions in engineering, manufacturing, warehousing and distribution, and customer service. Any plans, in particular? “Builders is a growth engine for the Massmart business,” she avers. “We aim to open at least 50 new stores in South Africa over the next five years. Hand in hand with this, we are looking to restore over 60 of our existing stores.” In other Massmart news, Saccawu is planning on extending its strike for a 12% wage increase at Makro to other Massmart stores.

Comment: Some big appointments there. We will watch their progress with considerable interest.

-

-

International Retailers Cruel Britannia

In the UK, two items that speak to the economic challenges faced by the glum denizens of that waterlogged archipelago, where inflation hit 16.7% in January. First up, in the face of falling sales, Tesco is cutting hundreds of management positions in its stores and closing all remaining food counters and hot delis as shoppers gravitate towards cheaper packaged goods. “Shift leaders”, who sound underpaid and hard-pressed, will replace store management. Some head office roles will also go, and the business is doing away with nightshifts for shelf packers and closing eight pharmacy businesses. Tesco expects that operating profit will decline slightly this year to somewhere around £2.5bn or just south. At Aldi and Lidl – different story. Aldi recorded a sales increase of +27% YoY in January, its fourth straight month of growth, and Lidl was just shy of that at 24%. Across the UK, punters are favouring the discounters, buying private brands, and putting fewer items in their trolleys to make ends meet.

Comment: Tough times as a number of forces – Brexit, Ukraine, supply chain issues – put the squeeze on the British economy.

MANUFACTURERS AND SERVICE PROVIDERS

-

Trading Updates Sometimes you got to HEP yourself

A few trading updates for you this week. First up, RCL FOODS, which has let it be known that HEPS will likely decline -27% for the six months through December on the back of tough market conditions and load shedding. It has experienced persistently high input prices and above-inflationary increases in areas like fuel and packaging costs. RCL’s decision to diversify into other foods must be a continued source of relief to the business; last month, you will recall, rival Astral warned that HEPS would likely decline by as much as -90% for the six months through March, exposed as it is more thoroughly to the vagaries of the poultry business. Next, Sea Harvest has warned of a likely decline in HEPS of as much as -35% for the year through December, chiefly as a result of a -10% decline in hake volumes quota losses from the Fishing Rights Allocation Process and a reduction in the Total Allowable Catch, although rising fuel costs, load shedding and increased interest rates also played a part. This despite an increase in revenue across all segments of the business on firm demand both globally and here at home. Finally, Super Group is expecting an increase in revenue of up to +40% for the six months through December, with HEPS up by as much as +35%.

Comment: In the case of RCL and Sea Harvest, great South African businesses battered by externalities over which they have no control, and the impacts of which they can only do so much to mitigate.

-

-

In Brief #squadgoals #glowgetsome

In news that has dismayed South African lovers of the rich, creamy, and entirely irreplaceable condiment – our own mother very much among them – Unilever has announced that it will be suspending sales of Hellmann’s mayonnaise, although its Food Solutions business will continue to take bulk orders. Hellmann’s is a small seller for Unilever, which is why it isn’t produced locally, and import costs have taken their toll. Unrelated – and hey, fam – Distell’s spritzer brand Bernini is launching a new 500ml variant to its afficionados, known to the brand as ‘Glowgetters’. Bernini (their words) is “suitable for any occasion with the squad, from summer picnics, poolside get togethers, brunches and lunches, sunset drinks, and elegant dinners.” Next up, South Africa’s sugar producers, represented by SA Canegrowers, are demanding proof from the Treasury that the sugar tax imposed in 2018 has reduced obesity across the country – and that in the absence of this proof, the tax be scrapped. The Treasury has not yet responded. Finally, the anti-dumping duties on imports of French fries from Germany, Belgium, and the Netherlands have been expired, providing relief to local on-sellers of up to 181% on the cost of the crunchy, golden staple.

Comment: Although without Hellmann’s to put on them, we have lost our appetite for those fries…

TRADE ENVIRONMENT

-

Prices The price of poverty

Last week’s increase in the price of fuel – 28 cents per litre for both 95 and 93 octane petrol, and up to 9c per litre of diesel – will put embattled South African consumers under further pressure, even as they steel themselves for April’s massive 18.5% electricity hike. “We are all hanging on by a very thin thread, and the most vulnerable households suffer the most when energy, fuel and food prices skyrocket,” says Debt Rescue CEO Neil Roets. “It is simply unacceptable that the powers that be continue to mete out this punishment, with seemingly no restraint. The general consensus among the country’s citizens is that nobody is listening anymore.” According to the Pietermaritzburg-based Economic Justice and Dignity group, 55.5% of South Africa’s total population – about 30.4 million people – live below the upper-bound poverty line of R1,417 per month – a point at which even marginal increases become unsustainable. Worse, 25.2% of South Africans – or 13.8 million people – live below the food poverty line of R663.

Comment: Tragic and infuriating, and a threat to lives, livelihoods, and the future of our country.

.png)